Germany is the largest energy market in Europe with a consumption of 517 Terrawatt hours in 2023 and 53% from renewable Energy. For that reason Germany currenty is a very attractive Market for large scale stand-alone BESS. The regulatory framework is clear and in favor of BESS. Access to the grid is still available. Day ahead and intraday Trading is possible and it gives attractive returns

An article from Timera Energy:

“A sharp increase in low / negative prices is helping support BESS revenue”

Germany is a hotspot of current investor focus on battery deployment. In today’s article we look at several key factors driving German BESS investment case value. We also set out some of the challenges investors are confronting.

Here are 5 key takeaways on German BESS investment state of play.

Renewables accounted for 57% of German generation output share in 2023 (about 32% of this from wind). The penetration of wind & solar capacity continues to grow rapidly and swings in output are driving a structural increase in the requirement for balancing flexibility.

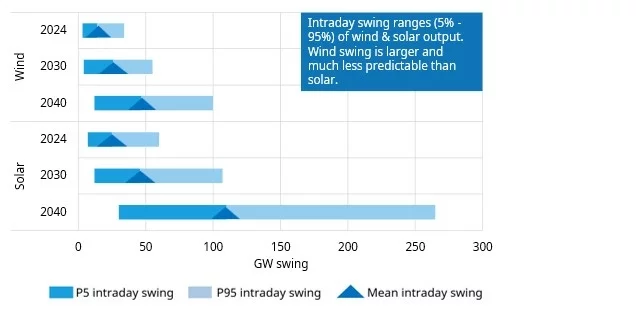

Chart 1 comes from our recent Q2 German BESS subscription service update, where our clients receive quarterly updated analysis of German power market and BESS revenue stack evolution to 2050. The chart shows our projected growth in intraday swings in wind & solar output. The blue triangles represent average intraday output swings, the bars around these the swing distributions (P5 & P95).

Source: Timera Energy

We project average within-day wind output swing of around 25GW (pre-curtailment), with solar outputs swings closer to 50GW by 2030. These drive very large intraday system balancing requirements.

Thermal plant closures are exacerbating the flexibility requirement. The German nuclear fleet is now fully closed and 34GW of coal & lignite capacity scheduled to close by the mid-2030s.

The investment case for BESS is underpinned by this structural requirement for investment in balancing flexibility.

Strong fundamentals are important, but investors also need a robust BESS revenue stack to earn a viable return on capital.

Chart 2 shows a backtest of historical German BESS revenue stack capture for a 2hr asset, using Timera’s BESS dispatch optimisation model.

Source: Timera BESS dispatch optimisation model

After surging above 200 €/kW/yr in 2022, German BESS revenues were predominantly in a 130-180 €/kW/yr for most of 2023, supported by strong intraday & aFRR revenues despite a material easing in power & gas price volatility.

Winter 2023-24 has been tough for BESS revenues across Europe, particularly in Q1 2024 when German revenues fell below 100 €/kW/yr. However revenues have started to recover in Q2 2024, helped by stronger FCR returns.

We will do a deeper dive into German BESS revenue stack evolution in our upcoming webinar (details below).

One of the key factors underpinning the German BESS investment case is a liquid & volatile intraday market. There are strong incentives to balance wind & solar output ahead of delivery in Germany and BESS assets are a key flex provider to enable this.

Volatility in both the Day-Ahead and Intraday markets in Germany is being supported by an increasing incidence of low & negative prices as RES penetration increases.

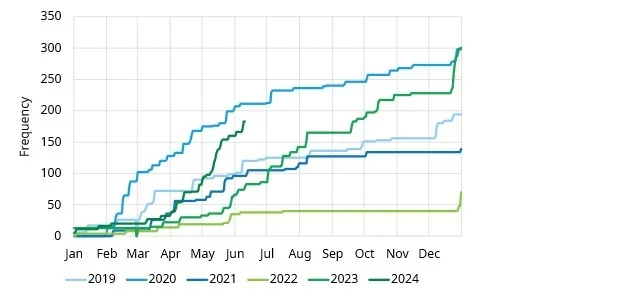

Chart 3 shows the cumulative frequency of negative Day-Ahead prices in 2024 vs the previous 5 years, with a significant rise in 2024 vs all previous years outside the Covid demand slump induced negative prices in 2020.

Source: Timera Energy

A similar trend is also taking place in the intraday market, which is both liquid & volatile in Germany. These conditions are causing intraday value capture to dominate BESS energy arbitrage revenues.

Ancillary revenues (e.g. aFRR / FCR) are also playing an important role in supplementing wholesale market returns for now, although as BESS capacity grows these markets are set to saturate relatively quickly.

There is an increasing appetite on the part of German banks for lending to BESS projects, to expand & diversify RES asset lending portfolios. Debt facilities are available on a both a floor protected and fully merchant basis.

Although the financing market is maturing it is not yet comparable to the maturity of BESS lending in GB. Banks are also increasingly wary of the levels & instability in lending case curves produced by some consultancies.

Most BESS projects in Germany are being developed using offtake contracts with 3rd party optimisers. The good news for developers is that optimiser competition is rising fast and offtake contract structure evolution is strong.

Tolling & offtake contracts with floors are available across 5-10 year terms across a broad range of structures, although available pricing terms have taken a hit since the weaker revenue performance across last winter.

Despite a strong requirement for investment in balancing flexibility, there are a number of practical challenges in building a scalable BESS portfolio in Germany. These include:

The German BESS landscape appears ripe for aggregation & consolidation. Foreign players with established platforms & management teams may play an important role here. As has been the case in the GB market, more agile fund backed players are likely to have a significant advantage over utilities and Stadtwerke (municipalities).

Press: